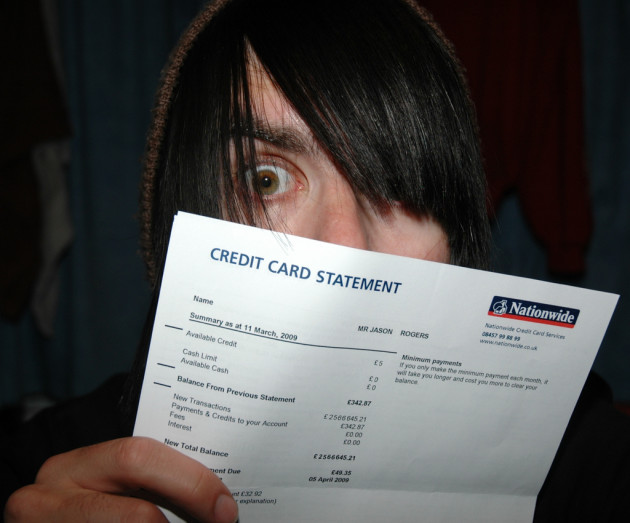

photo by 401kcalculator.org For college students and their parents alike, there comes a different set of tax requirements. Without taking the proper steps and becoming educated on the right tax filings for students, many deductions and write offs may be missed. The process can become complicated, and mistakes can mean costly effects on a college kid’s bank account. For the students filing for the first time it can be a hairy process to determine exactly what to put within forms, and for parents navigating taxes during their child’s first year of college, the alterations might be more complicated than expected.…

Tax Tips for College Students