Investing that hard-earned money demands sincerity and research. You cannot just drop your savings or that moolah into a plan that doesn’t give you any benefit in return. It is essential that the money you have invested grows over a period and allows you to withdraw it whenever there is an emergency. Making you money work for you is what financial and non-financial institutions focus on and that is what you should be investing in.

Life Insurance Corporation of India is one of the most reputed organisations in the country who follows the principle where customer comes first. With their numerous policies and plans, they have not only managed to increase their foothold all over the country but are singularly the largest insurance providers in the country.

LIC market plus plan is a kind of pension plan which is made available to the customer with an option of a life insurance or getting one without it as well. It allows the customer to choose from a myriad of funds which are further invested exposing it to the risk of the market which can swing either in favour of the customer or otherwise. The customer has the prerogative to choose the cover, the mode of premium payment and the duration or interval of when the premium can be paid over a period. Having said that, it is flexible and allows you to build your corpus with multiple benefits which lack in leading investment firms or even insurance providers.

The Major Features of the LIC Market Plus Plan

It is only obvious that a popular plan such as that of the LIC market Plus plan would have major benefits. It is easier to understand and doesn’t juxtapose you with several options or terms which sound gibberish.

You Have the Option to Pick a Plan with Live Cover and Without Life Cover

It might sound like a ULIP plan which allows you to invest partial money in life insurance and invest the rest in different funds such as equities or dividends or bonds. Well, the LIC market plus plan allows you the same benefits in a different way.

- Without Cover

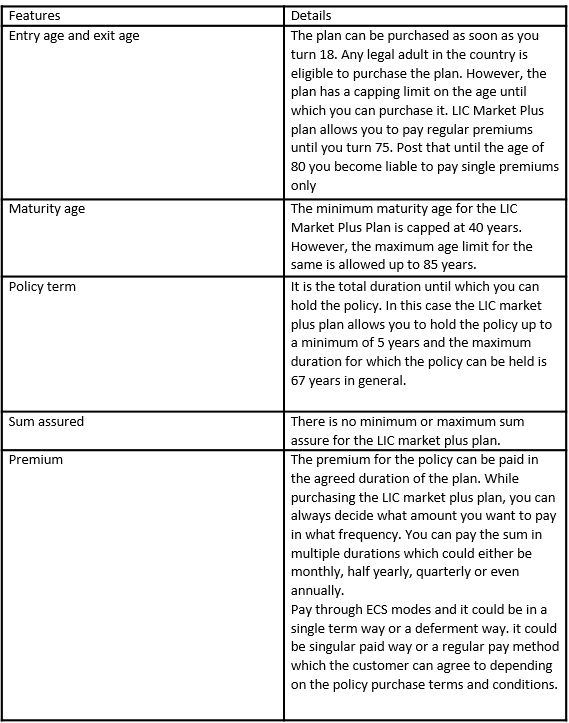

The life insurance plan, the LIC market plus plan, allows you to choose a cover with whatever premium you want to pay. The plan allows you to purchase the plan as soon as you turn 18 and you can hold the policy until you turn 80. Even if the maximum age is 75, the plan can be extended until 5 years where you become eligible to pay those single premium plans

- The funds that are invested in the market can be moved across funds such that it is more profitable for you. It is easy and more comfortable when you have a dedicated agent working for you and advising you correctly.

- The LIC market plus plan has a lock in period of 3 years unlike those of fixed deposits for 5 years.

- You cannot avail loan facility against the LIC market plus plan. This ensures that your fund develops and performs such that you get a good sum at the end of the policy maturity.

- The LIC market plus plan allows you to test the plan for 15 days. This is the cooling off period where you can decide if this is the plan you want to stick to or move away to other ones. This gives you a choice of to have control over your own money without risking it completely.

- You, as a customer, also get the option to buy a pension plan by vesting in it. All you need to do is inform the LIC market plus plan issuer about the decision.

- You get annuity which is a pay-out. In case you decide to commute the funds, you get a reduced amount instead of lump sum.

- With Cover

The insurance cover that you purchase along with the LIC market plus plan gives you an assured sum of 30,000 INR. The maximum sum assured however, varies from plan to plan. It is possible that you might have purchased a critical illness rider plan to protect you in the time of need. In case you have purchased it, you become eligible to be paid 10-times the annual premium that you have been paying if you are below the age of 40. In case you are above the age of 40, you get 5 times of the premium amount that you have been paying.