Business professionals often debate whether it is a better decision to pursue the CFA designation on its own or earn an MBA degree with a concentration in finance. While certain observers predict that the Chartered Financial Analyst designation will outstrip a graduate business degree, others have pointed out that there may not be a “one or the other” debate in the future. Instead, the best programs in Canada are introducing a “CFA track” to their curriculum by including course material that prepares students for the rigorous CFA testing process.

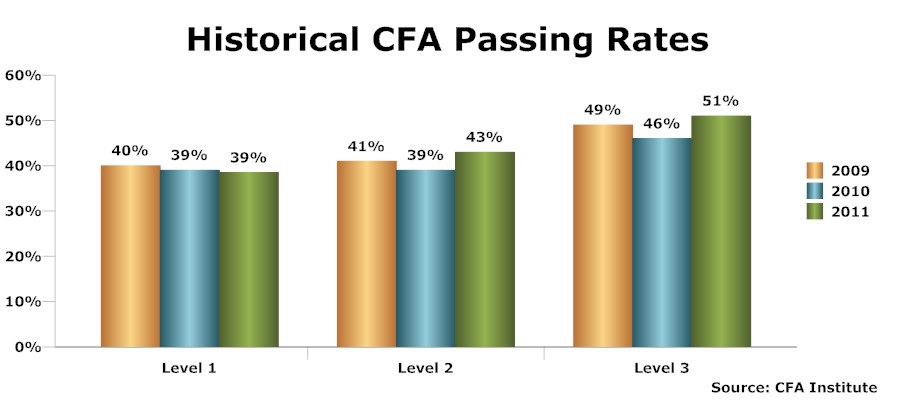

The Chartered Financial Analyst examination has three tiers, and charter holders must also complete 4 years of relevant work experience. The difficulty of the exams makes the CFA designation one of the most sought-after in the world. There are only 120,000 charter holders globally, enough that it’s a commonly recognized qualification, but still seen as a challenging one to achieve. The pass rate for all three levels over the last ten years has been less than 40%. Despite the challenges, anyone who wants a career as a decision-maker in hedge funds, insurance companies, mutual funds, or investment banks should be planning to take the exams. How you prepare can play a big role in whether or not you pass.

The CFA Institute has been working with business schools to incorporate exam preparation into their Master of Finance programs. In Toronto, Canada’s centre for financial services, a combined MBA/MFin double degree is offered by Wilfrid Laurier University that prepares students for the CFA level I and II exams. Seventy percent of what the Institute considers to be part of the “Candidate Body of Knowledge” necessary for passing the exams is taught in the program. Over a period of four years, you can earn an MBA/MFin and prepare for one of the most sought-after business designations on alternating weekends. If you want to get an edge, choose a Masters of Finance program in Canada that prepares you for the industry’s toughest accreditation exams.

Holding the charter is quickly becoming a necessary credential if you are looking to jump into investment management. However, there are also plenty of financial professions where it will give you an edge without being a requirement. When it comes to salary expectations, an MBA can lead to a significant increase, but Business Insider reports that those with just a Chartered Financial Analyst designation earn $15,000 to $27,000 more. People with both credentials and ten years or more of experience earn an extra $43,000.

Professionals who have their eye on Bay Street or other international financial centres may already know that they don’t need the generalized knowledge of an MBA. Instead, they should focus on a Master of Finance degree that allows them to simultaneously prepare for the CFA exams. They can earn a finance degree part time in downtown Toronto in only two years with Wilfrid Laurier, while working a full time career. There is no replacement for experience in the investment world, however, a strong educational background in financial analysis can be the difference that ushers you into a new career in the first place. The CFA is proof that you’ve got a strong analytical mind, endured highly selective testing, and come out ahead of the crowd.