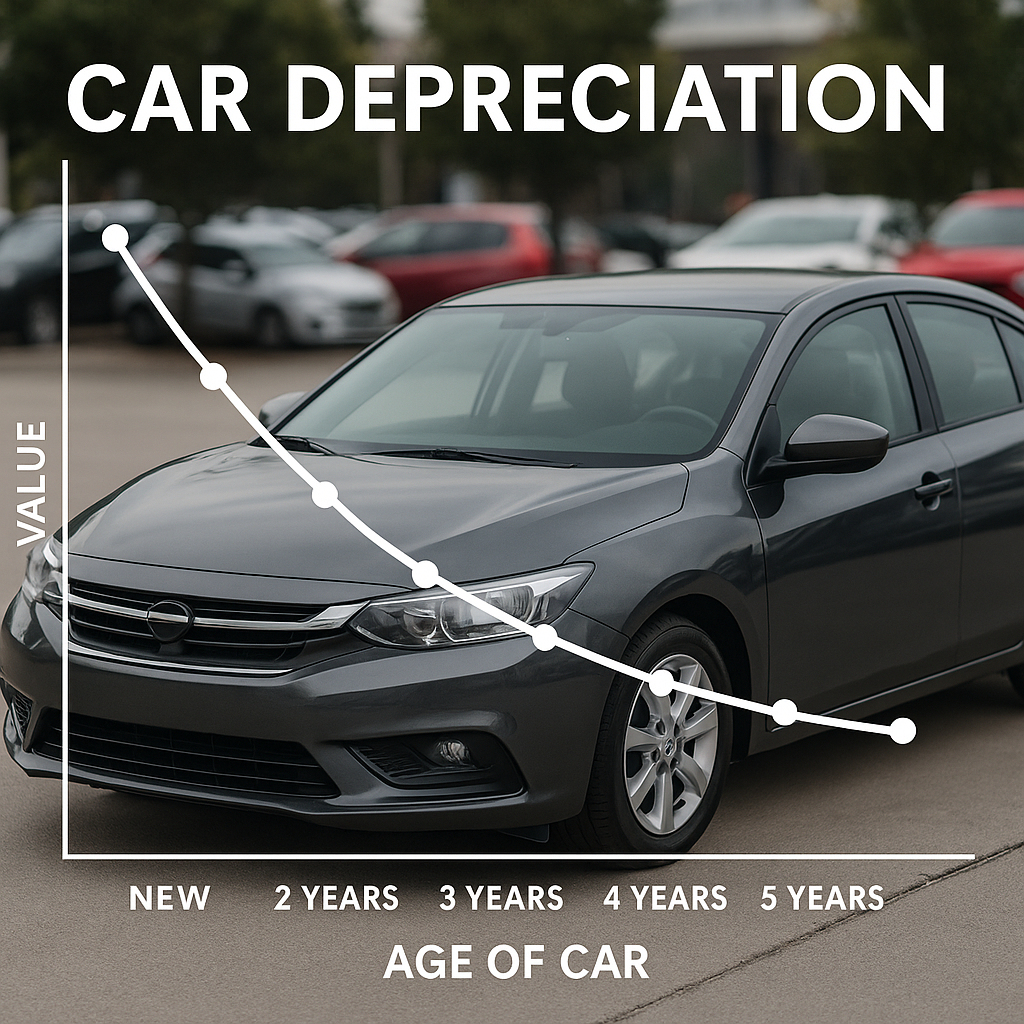

New cars lose value at alarming rates during their first few years. That brand new vehicle driven off the lot immediately drops thousands in value. After a year, it’s worth significantly less than purchase price despite being barely used. This steep depreciation continues through years two and three, with the vehicle shedding value faster than most owners expect. But this dramatic value loss doesn’t continue forever. At a certain point, the depreciation curve flattens considerably. Vehicles reach an age where they still have plenty of useful life but have already absorbed most of the steep early depreciation. This sweet spot represents where smart buyers can get maximum vehicle for their money – cars that work perfectly well but cost a fraction of their original price.

Understanding where this stabilization happens helps identify the best value point in the used car market. Too new and you’re still paying for rapid depreciation. Too old and maintenance costs start offsetting the lower purchase price. The sweet spot sits right in the middle, where depreciation has slowed but the vehicle remains reliable and desirable.

The Steep Depreciation Years

New vehicles lose roughly 20-30% of their value in the first year alone. A $40,000 car becomes a $28,000-32,000 car after twelve months, even with low mileage and perfect condition. This isn’t because anything’s wrong with the vehicle – it’s simply the premium people pay for being the first owner and having that new-car status.

Years two and three continue this trend, though slightly less dramatically. By the end of year three, most vehicles have lost 40-50% of their original value. That $40,000 car might be worth $20,000-24,000 despite being only three years old and having plenty of life remaining. The depreciation during these early years is essentially a cost paid by the first owner for having a new vehicle.

This steep early depreciation happens regardless of how well the vehicle is maintained or how little it’s driven. A three-year-old car with 15,000 miles has depreciated almost as much as one with 45,000 miles, assuming both are in good condition. The age itself drives most of the value loss during these initial years.

Where the Curve Flattens

Around years four through six, something shifts. Depreciation continues but at a much slower pace. Instead of losing 10-15% annually, vehicles in this range might lose 5-8% per year. The dramatic cliff of early depreciation gives way to a more gradual slope.

This happens because the vehicle has already shed its new-car premium and its nearly-new premium. What remains is value based more on actual utility and condition than on age status. A five-year-old car doesn’t depreciate much more sharply than a four-year-old car because neither carries any prestige for newness. They’re both simply used cars at this point, valued for their function rather than their age.

This flattening creates opportunity. Buyers shopping in the four-to-six-year-old range find vehicles that have absorbed most of the steep depreciation but typically haven’t yet reached the age where major maintenance becomes common. These vehicles often have 40,000-80,000 miles – well within their useful life for most modern cars – but cost 50-60% less than when new.

Markets with diverse inventory such as used cars perth dealers often show this pattern clearly when comparing pricing across vehicle ages. The price drops between new and three years old are dramatic, while the drops between four and seven years old are much more moderate relative to the amount of usable life remaining in the vehicles.

Why This Sweet Spot Delivers Value

A five-year-old vehicle in good condition provides essentially the same transportation as a two-year-old version of the same model, but at significantly lower cost. The newer car has more warranty coverage remaining and slightly less mileage, but these advantages rarely justify the price difference for buyers focused on value rather than newness.

Modern vehicles routinely last 200,000 miles or more with proper maintenance. A five-year-old car with 60,000 miles has potentially 140,000 miles of useful life ahead – years of reliable transportation for someone who maintains it properly. Yet it costs maybe $18,000 instead of the $35,000 a two-year-old version commands or the $40,000+ when new.

This value proposition becomes even stronger when considering total cost of ownership. The lower purchase price means lower financing costs, lower insurance premiums, and lower registration fees in many locations. These savings accumulate over the years of ownership, making the total cost difference even more significant than just the purchase price gap.

Balancing Age Against Maintenance Realities

The sweet spot exists where depreciation has slowed but maintenance costs haven’t yet accelerated significantly. This window varies somewhat by vehicle make, model, and how well previous owners maintained them, but generally the four-to-seven-year range hits this balance well for most vehicles.

Younger than four years and depreciation remains steep relative to the condition and utility gained. Older than seven or eight years and vehicles start needing more maintenance as wear items age out. Timing belts, water pumps, suspension components, and other parts often need replacement around 80,000-100,000 miles. Vehicles entering their eighth or ninth year frequently hit these maintenance milestones.

This doesn’t mean eight-year-old vehicles are bad purchases – they offer their own value proposition for buyers comfortable with maintenance or looking for lowest possible purchase price. But the sweet spot for combining lower depreciation with minimal major maintenance sits in that four-to-seven-year window for most makes and models.

Model-Specific Variations

The general pattern holds across most vehicles, but specific models vary in their depreciation curves and value retention. Luxury vehicles often depreciate more steeply in early years, meaning their sweet spot might offer even better value but also potentially higher maintenance costs. Popular mainstream vehicles hold value better initially but still reach a stabilization point around year five.

Trucks and SUVs typically hold value better than sedans, meaning their depreciation curves flatten at slightly higher price points. Sports cars often see steeper early depreciation than practical vehicles. Understanding these patterns helps identify where the sweet spot sits for specific vehicle types of interest.

The Remaining Useful Life Calculation

Part of what makes the sweet spot valuable is the ratio between cost and remaining useful life. A five-year-old vehicle at 50% of original price but with 70% of its useful life remaining offers better value than a three-year-old vehicle at 70% of original price with 80% of useful life remaining. The math favors the older vehicle in terms of cost per expected year of use.

This calculation assumes proper maintenance, which is why vehicle history and condition matter enormously when buying in this age range. A well-maintained five-year-old car offers better value than a neglected three-year-old car despite the newer vehicle’s age advantage.

Market Timing Considerations

The sweet spot vehicles age into and out of this range constantly. A four-year-old car today becomes a five-year-old car next year. This creates a continuously replenishing supply of vehicles in the value zone for buyers who understand where to look.

Seasonal patterns affect availability and pricing within this age range. More inventory often appears in certain months as leases end and people trade vehicles. Understanding these cycles helps time purchases for best selection and pricing.

Finding Quality Within the Sweet Spot

Not all vehicles in the four-to-seven-year range offer equal value. Condition, maintenance history, and mileage all affect whether a specific vehicle represents a smart purchase. The sweet spot identifies the age range – individual vehicles within that range require evaluation to determine if they specifically deliver the value the age range promises generally.

Vehicle history reports, mechanical inspections, and honest assessment of condition separate genuinely good deals from vehicles that just happen to be the right age. The sweet spot provides the general framework, but due diligence ensures specific purchases deliver the expected value.

The Long-Term Satisfaction Factor

Buyers who purchase in the depreciation sweet spot often report high satisfaction because they get reliable transportation at prices that don’t strain budgets. The vehicles serve their purpose well without the financial stress of high payments or the maintenance concerns of much older vehicles.

This satisfaction comes from alignment between cost and utility. The vehicle cost what it’s actually worth as transportation rather than what it’s worth as status or novelty. That practical value proposition creates contentment that lasts throughout ownership.